Interim Results for the half year to 29 November 2025

Strong performance, with broad-based growth. Increased FY26 operating profit expectations.

Jonathan Myers, Chief Executive Officer, said: “We have delivered a strong performance in the first half of the year across our four lead markets. This performance, with a healthy balance of price and volume increases, and growth in each of our largest ten brands, has been driven by targeted investment in innovation, brand-building and continued strong commercial execution. Combined with tight cost control, we delivered double-digit growth in adjusted operating profit and adjusted earnings per share allowing us to increase guidance for the full year.

We have concluded our strategic review, which has resulted in a significantly strengthened balance sheet and a more focused and more resilient business. Against this backdrop, we are setting out plans in our Capital Markets Event to deliver sustainable shareholder value, building winning portfolios of locally-loved brands in four lead markets. With a balance between developed and emerging markets and building on competitive go-to-market capabilities and manufacturing scale, we are targeting double-digit total shareholder return through the cycle.”

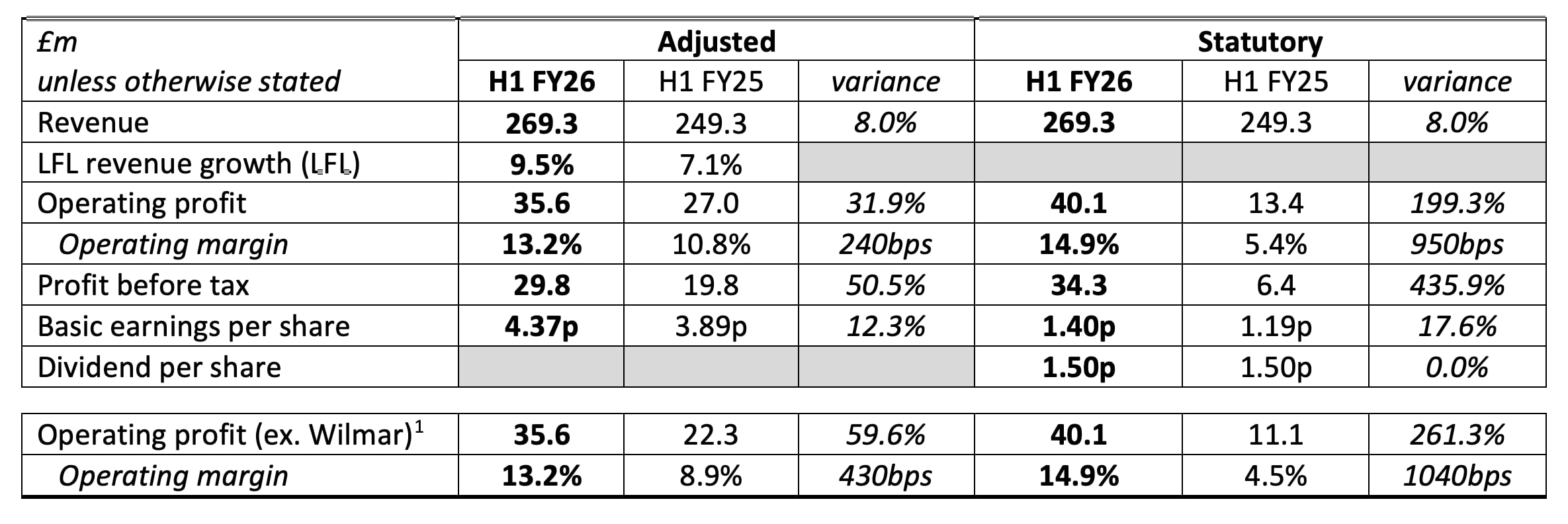

See pages 11-14 for the reconciliation between Alternative Performance Measures and Statutory results.

Numbers are shown based on continuing operations. With the exception of LFL revenue growth, % changes are shown at actual FX rates.

H1 FY26 refers to the 6 months ended 29 November 2025 and H1 FY25 refers to the 6 months ended 30 November 2024.

1 Adjusts H1 FY25 to remove profit associated with PZ Wilmar joint venture

Summary

Financial results

- Broad-based LFL revenue growth of 9.5% with growth in each of our four lead markets (UK, ANZ, Nigeria and Indonesia):

- UK – growth led by Sanctuary Spa with successful Christmas gifting in a continued competitive environment

- ANZ – a return to category growth, with continued strong market share

- Nigeria – annualising pricing increases with double-digit volume growth with most brands gaining market share

- Indonesia – strong growth driven by innovation and commercial execution

- Excluding Africa, LFL revenue growth was 3.2% with volume growth of 0.7%.

- Reported revenue increased 8.0% reflecting the depreciation of the Australian Dollar and Indonesian Rupiah versus Sterling.

- Excluding the contribution from the PZ Wilmar joint venture in the comparative period, adjusted operating profit increased by £13.3 million. This reflected a strengthening of the Nigerian Naira driving non-cash FX gains on trading liabilities and planned phasing of marketing where investment will be weighted towards H2.

- Adjusted profit before tax increased 50.5%, reflecting the increased operating profit and lower interest costs.

- Adjusted EPS increased by 12.3%, with increased PBT partly offset by an increase in the Group’s effective tax rate due to geographic profit mix with a normalised Nigeria tax rate and the impact of the PZ Wilmar disposal.

- Net debt declined by £27.7 million compared to 31 May 2025, driven by free cash flow of £23.2 million and proceeds from portfolio transformation activity.

Delivery against our strategy

- £48.5 million proceeds received to date in respect of the sale of our 50% stake in the PZ Wilmar joint venture, with a further £3.4 million expected over the coming weeks.

- Renewed strategy for St Tropez; successful transition to Emerson partnership in US driving revenue growth but offset by a decline in revenue outside of the US.

- Cost savings programme on track with c.£5-10 million expected in FY26.

Dividend

The Board is declaring a dividend of 1.50p per share, in line with last year’s payment. The dividend will be paid on 9 April 2026 to shareholders on the register at the close of business on 6 March 2026.

Capital allocation policy

As set out at today’s Capital Markets Event, the Board has adopted the following capital allocation policy. This defines the use of surplus cash after re-investment in the business as follows:

- Net debt / EBITDA to be in the range of 1.0-1.5x, excluding cash held in Nigeria;

- A progressive dividend;

- Bolt-on M&A, prioritising UK and Australia, to be considered alongside cash returns to shareholders.

Current trading and FY26 outlook

Trading to the end of January has been in line with our expectations, with continued strong LFL revenue growth.

Given the strong financial performance to date, subject to FX movements in the final months of the financial year, the Group expects to deliver:

- Adjusted operating profit: £53-57 million (£50-55 million previously);

- Gross Cost savings: c.£5-10 million (unchanged), with the majority re-invested in marketing, brand-building and people;

- Net debt / EBITDA: expect to end FY26 at approximately 1.0x (adjusted to exclude cash held within Nigeria), reflecting cash proceeds of £20 to £25 million for the sale of non-operating surplus assets, of which £15.8 million have been received to date.

Read the full release here – Interim Results for the half year to 29 November 2025